Nba Players Pay Taxes In Every State The four main types that the average NBA player pays are Federal tax State tax City tax Jock tax Technically 29 of the 30 NBA franchises are subject to US federal taxes with the exception of those from the only non US based team the Toronto Raptors who are required to pay their income tax in Canada

NBA players face significant tax obligations due to playing in various states each with its own tax code Players must pay income taxes in every state where they earn income a concept known as the jock tax For example a game in California exposes players to a state income tax rate of up to 13 3 one of the highest in the country This created a snowball effect and today nearly every state except for Florida Washington Texas and Washington DC enforces a tax on visiting players Over the course of an NBA season

Nba Players Pay Taxes In Every State

Nba Players Pay Taxes In Every State

Nba Players Pay Taxes In Every State

https://www.hoopsaddict.com/wp-content/uploads/2023/11/Do-NBA-Players-Pay-Taxes-in-Every-State-They-Play-In.png

Do NBA Players Pay Taxes in Every State They Play In The short answer to this question is no You see not every state in the USA charges taxes so even though players are subjected to jock taxes in most states they play in they aren t subjected to jock and state taxes in all of them Players will pay taxes for playing in every state except

Templates are pre-designed files or files that can be used for various purposes. They can save time and effort by offering a ready-made format and design for creating different sort of material. Templates can be used for personal or expert tasks, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Nba Players Pay Taxes In Every State

Do Foreign NBA Players Pay Taxes Victor Wembanyama Case Study

Tax Clearances TaxAppCy

.png?format=1500w)

This Is How Overseas Basketball Players Pay Taxes How Often How Much

How Taxes Work For NBA Professional Athletes And Coaches

Highest Rated IPAs In Every State 2024 MAP

The Most Beautiful Private High School In Every State In America Artofit

https://www.mightytaxes.com/jock-tax-professional-athletes-state-tax/

A tax bill of 7 000 per game isn t much to someone like Panthers quarterback Cam Newton who collects 20 million in salary but to a player making the league minimum currently 450k per year such an arrangement can be very costly and very time consuming Professional athletes pay taxes in every state they play in during the season which can make things very confusing when

https://www.msn.com/en-us/sports/nba/how-much-do-nba-players-really-pay-in-taxes/ar-AA1AIuOV

This means that from that 30 million an NBA player must pay 10 million in taxes at minimum And that s before the state tax which can vary wildly The top rate in California is 13 3 which

https://www.gobankingrates.com/net-worth/sports/how-much-star-athletes-pay-in-taxes/

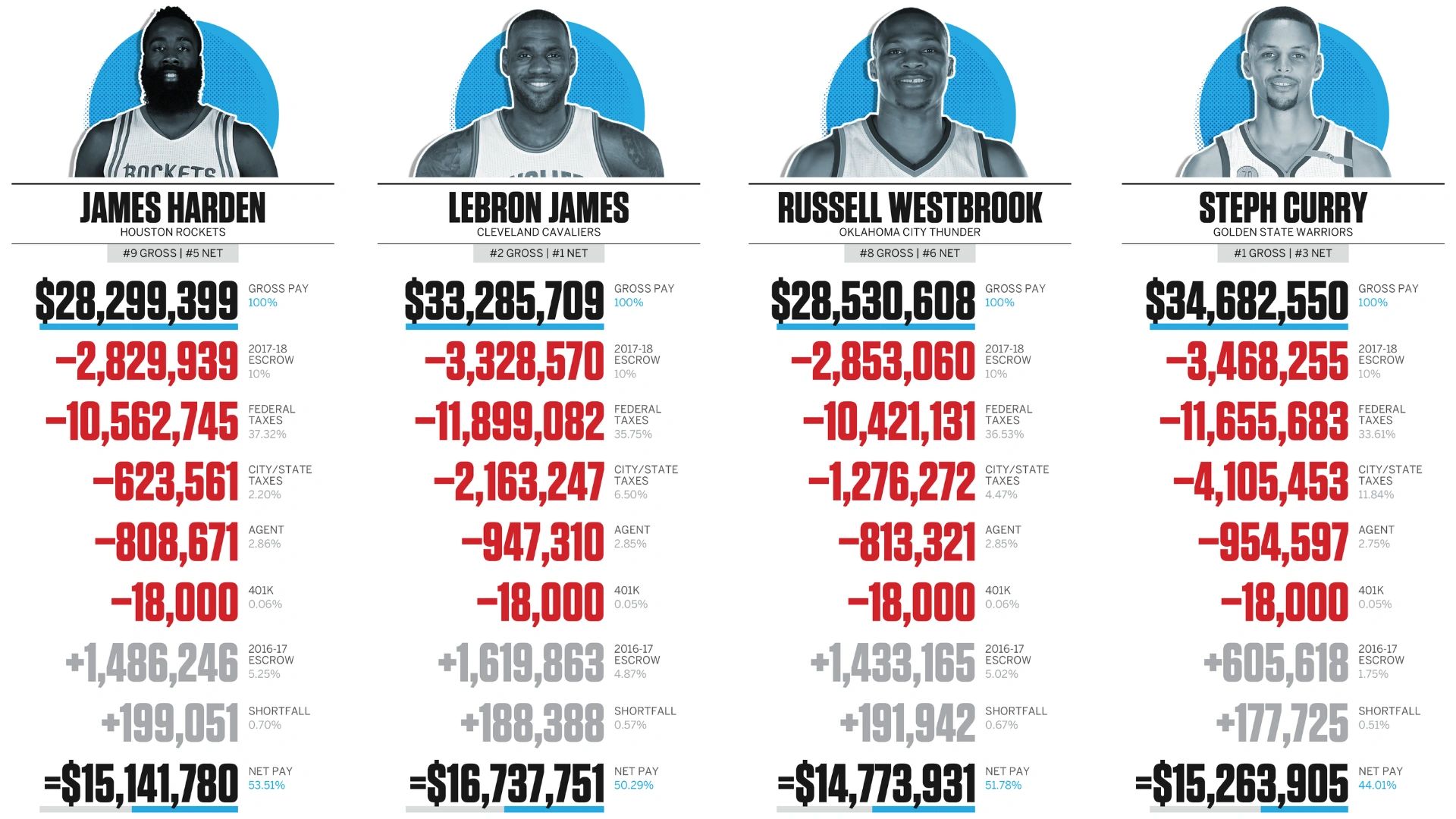

Methodology For this piece GOBankingRates first sourced the top 10 highest paid players in the NFL NBA and MLB and sourced each player s 1 current or upcoming seasons salary With these 30 athletes isolated GOBankingRates then used our in house federal and state income tax calculators to find each athlete s 2 federal income taxes paid 3 state income taxes paid 4 FICA taxes

https://www.forbes.com/sites/kurtbadenhausen/2017/04/18/income-taxes-for-pro-athletes-are-reminder-of-how-complicated-u-s-tax-code/

Athletes file taxes not only in their home state but also in every state and some cities in which they play An NBA player visits 21 states during a season

https://sage-answer.com/do-nba-players-get-taxed-in-each-state/

Do sports players have to pay taxes in every state In other words players must file separate tax returns for every state where they play an away game unless that state lacks an income tax like Florida How do taxes work for NBA players The federal income tax has a rate of 37 percent in the USA and 33 percent in Canada for NBA players

[desc-11] [desc-12]

[desc-13]