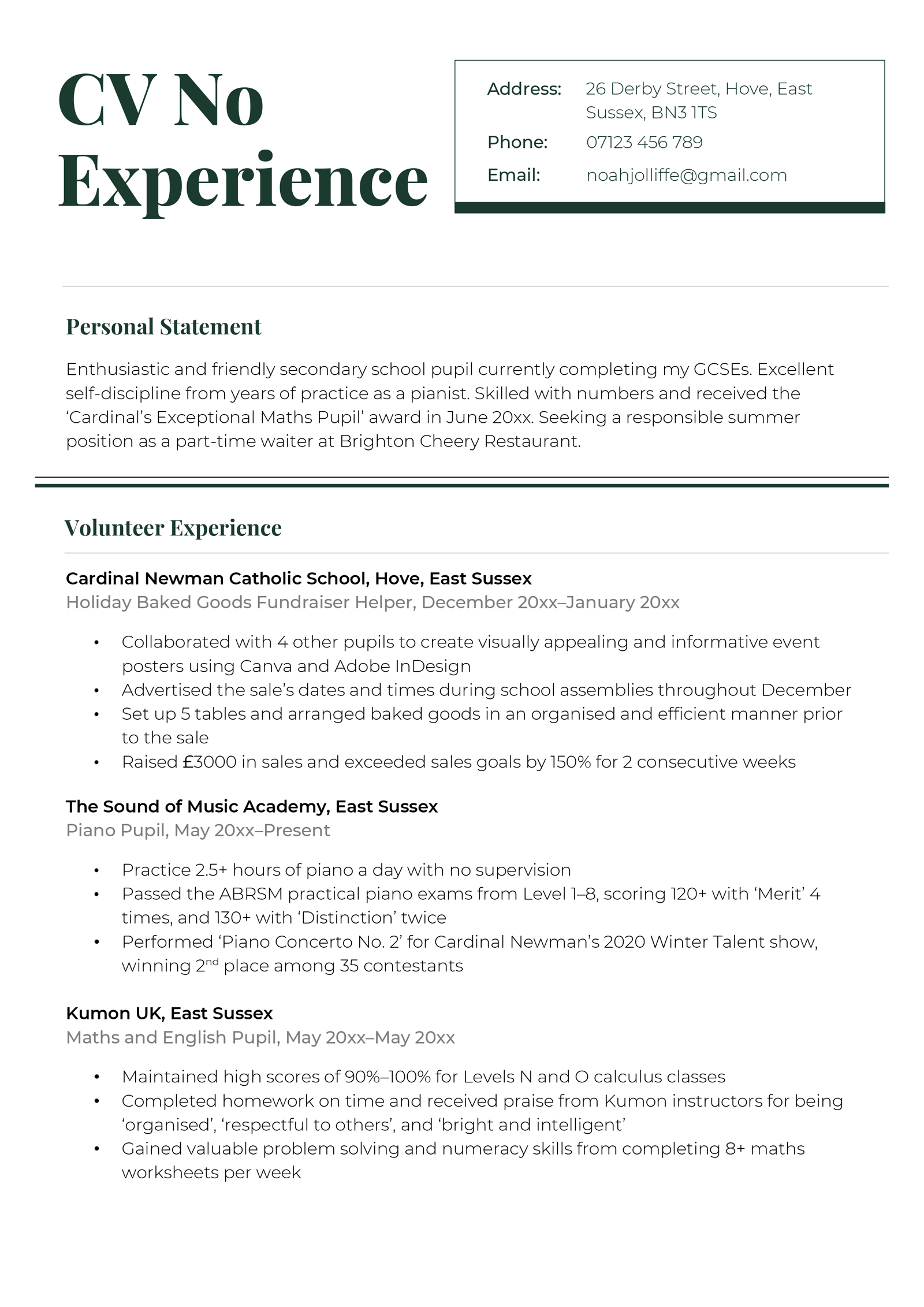

Cards For 17 Year Olds What are the best credit cards for teens Written by Clint Proctor Updated August 15 2023 6 min read In a Nutshell Teens can apply for their own credit cards when they turn 18 The best credit cards for teens have low credit requirements and keep costs to a minimum

There are many debit cards for kids and teens that offer young users the autonomy to deposit money make purchases and track their spending all while giving parents control and peace of mind Monthly Fee 4 99 to 14 98 month up to 5 kids Reload Fee N A Minimum Age None Sign Up Now Why We Chose It The Greenlight Kids Debit Card is our top overall pick for teens offering chore

Cards For 17 Year Olds

https://images.squarespace-cdn.com/content/v1/5b599167cef372c8f893096d/1583725660520-X4EUMX0OZ3ZCFMW10CBA/17-YEA~1.JPG

Getting a credit card Key points about the best credit cards for teens Teenagers must be eighteen or older to apply for a credit card in their name Student and secured credit cards are great options for teens eighteen or older with little to no credit history

Templates are pre-designed documents or files that can be used for numerous functions. They can save effort and time by offering a ready-made format and design for developing various type of content. Templates can be utilized for individual or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Cards For 17 Year Olds

CV For A 16 Year Old Template Examples How To Write 2024

Adasea 5042 Kids Swimdress

Best Tween Movies Good Movies For Tweens Movies For T Vrogue co

Pin On Lia s Hair

Sale Sweetheart Short Sleeve Swimsuit In Cotton Candy Size Etsy In

Best Teenager CV Examples Samples UK

https://www.cardrates.com/advice/best-credit-cards-for-16-and-17-year-olds/

9 Best Credit Cards For 16 17 Year Olds Dec 2023 Written by Eric Bank Edited by Lillian Guevara Castro Reviewed by Ashley Fricker Updated November 25 2023 A mid teen can do so many things but owning a credit card account will have to wait until you reach 18

https://www.cnet.com/personal-finance/credit-cards/best/debit-cards-for-kids-and-teens/

Best Debit Cards for Kids and Teens in December 2023 GoHenry BusyKid and More Debit cards for children and teens offer a variety of services and features to kickstart healthy financial

https://www.cardrates.com/advice/best-prepaid-debit-cards-for-minors/

1 Greenlight Debit Card For Kids at the issuer s secure website EXPERT S RATING 4 8 OVERALL RATING 4 2 5 0 Greenlight is a debit card for kids managed by parents Parents set flexible controls and receive real time alerts while kids monitor their balances set goals and learn how to manage money

https://www.chase.com/personal/credit-cards/education/basics/children-credit-cards

Some issuers have minimum age requirements that necessitate users must be at least 13 or 16 years old Once your child becomes a legal adult at 18 they may be able to become primary cardmembers albeit with restrictions For those under the age of 21 by law under The Credit CARD Act of 2009 credit card issuers must require applicants to

https://www.self.inc/blog/how-to-build-credit-at-17

Don t know which credit cards for 17 year olds are best Following these steps will help you establish credit at 17 in a way that offers benefits for decades to come Why start building credit before turning 18 Credit scores and credit reports are an important part of personal finance

Best for Earning Interest Capital One MONEY Teen Best for Multiple Users Bluebird Prepaid Debit Card Best for Online Security Jassby Virtual Debit Card Best Checking Account Debit Card Chase First Banking Best Prepaid Reloadable Card FamZoo Best for High Spending Limits American Express Serve Debit cards for teens are similar to other debit cards and allow young adults the freedom to make purchases without cash However they also include parental controls to keep them from making big mistakes and educational resources that can teach them financial literacy

Most major credit card companies with the exception of Citi will allow you to add authorized users under the age of 18 though Amex and Discover require them to be at least 15 years of age and Barclays at least 13 years of age